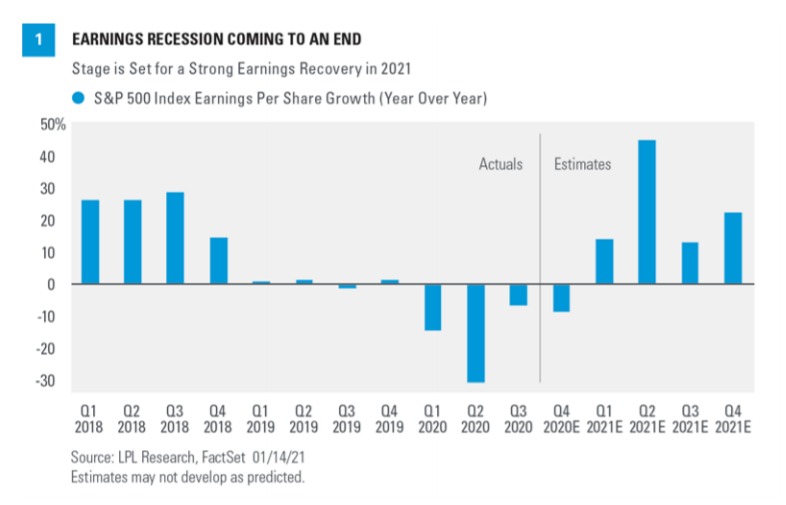

This earnings season likely will be the last of the earnings recession. After year-over-year declines in the first three quarters of 2020, the fourth quarter likely will make it four in a row. Looking ahead, earnings are likely to grow solidly in the first quarter 2021 and throughout the year, which we think will enable stocks to grow into their lofty valuations.

EXPECT MODEST EARNINGS DECLINE

We expect solid upside to S&P 500 corporate earnings relative to current estimates. However, expecting a year-over-year increase may be too much to ask. Consensus is calling for a roughly 8.5% year-over year decline in earnings per share (EPS) according to FactSet’s estimates [FIGURE 1].

We expect earnings to surprise to the upside by a solid margin again this quarter for a number of reasons.

Higher estimates. Estimates for the fourth quarter have risen by about 2.3% since October 1, 2020, which signals companies will be able to deliver at least the typical several percentage points of upside. Estimates typically decline by about 4% during a quarter.

Manufacturing is booming. The Institute for Supply Management (ISM) manufacturing index reached its second highest level in 15 years in December (60.7). Historically, the ISM index has been a leading indicator of upside earnings surprises and correlated well with corporate profit growth.

Solid economic growth. Even though some economic data—particularly the jobs report and retail sales for December—has suggested that a pause in the economic recovery occurred in late 2020, the US economy likely grew in the quarter. Bloomberg’s consensus gross domestic product (GDP) growth for the fourth quarter is 4.2% annualized. Even though economic surprise indexes (measures of how frequently economic data exceeds expectations) weakened some during the quarter, they remained in positive territory.

So how good could numbers be relative to expectations? The US economy’s soft patch that developed late last year amid the latest wave of COVID-19 may limit upside. Also consider that the bar has been raised substantially over the past two quarters, making it tougher to clear. That probably takes positive earnings growth off the table, but a low-to-mid-single-digit decline in earnings would be a positive outcome, especially if forward estimates hold up as fresh guidance is provided. Further, just getting last year’s results fully behind us and turning investors’ focus more to 2021 should help buoy investor sentiment.

FOUR KEY EARNINGS QUESTIONS

We’d like to get answers to four key questions this earnings season:

1) What will the impact of COVID-19 be in the first quarter of 2021? The increase in analysts’ earnings estimates—as we saw last quarter—reflects increased confidence in the profit outlook despite the ongoing pandemic. However, new restrictions imposed late in the quarter that remain in place today may temper enthusiasm for the earnings recovery in early 2021.

2) Will results support continuation of the cyclical value trade? Cyclical value sectors such as energy, financials, and industrials have seen very strong performance of late. These sectors were top performers during the fourth quarter, have continued that momentum, and are each outperforming so far in 2021. Given that the latest wave of COVID-19 and resulting restrictions have caused an economic soft patch over the past couple of months, we think it’s fair to say there is some risk that results and guidance across these sectors may not be good enough to please the market.

3) Can the winners keep carrying us? The Russell 1000 Growth Index is expected to grow earnings 6% year over year in the fourth quarter, compared to the 12% decline expected for the Russell 1000 Value Index. If earnings growth is to resume broadly, we need stronger earnings growth from growth style stocks—many of which are so-called “stay-at-home” stocks in the technology and internet areas—and some help from the economically sensitive value-style stocks that have struggled during the pandemic.

4) Will cost pressures show up in profit margins? It may be too soon to worry about this, but the latest rise in interest rates and commodity prices may influence the profit margin assumptions management teams make when sharing their earnings outlooks. Operating margins have come down a couple of percentage points during the pandemic, and companies may struggle to push them higher in the first quarter as the pandemic lingers.

STRONG EARNINGS RAMP AHEAD

Perhaps the most important element of this earnings season is whether company management teams can instill confidence in the strong earnings rebound baked into analysts’ forecasts. This becomes particularly important for a stock market that is trading at elevated valuations and keying on profits in 2022 and beyond during this challenging and unprecedented economic environment.

Despite lingering effects of COVID-19, in 2021 we expect the economic recovery—in the United States and internationally—to drive a big rebound in corporate profits. Boosted by cost efficiencies achieved during the pandemic we potentially could see S&P 500 earnings growth of 25% in 2021. Our forecast for S&P 500 EPS in 2021 is $165, slightly above 2019 pre-pandemic levels.

As the threat of COVID-19 diminishes and the economy moves toward fully reopening, we anticipate corporate America will begin to showcase its much-improved earnings potential. Up to $190 per share in S&P 500 earnings could be possible in 2022, a 15% increase from our 2021 estimate. A potential increase in the corporate tax rate in 2022 under a Democratic-controlled Congress introduces risk to this estimate.

REITERATING LPL RESEARCH’S POSITIVE STOCK MARKET OUTLOOK

We see an S&P 500 Index fair value target range of 3,850–3,900 at year-end 2021, with potential for upside if there’s better-than-expected progress on vaccine distribution and additional stimulus. A strong earnings rebound may enable stocks to grow into somewhat elevated valuations. Meanwhile, the ongoing pandemic presents lingering risk in the near term. Our S&P 500 target is based on a price-to earnings (PE) multiple slightly above 20 and our preliminary 2022 earnings forecast of $190.

Click here to download a PDF of this report.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

Please read the full Outlook 2021: Powering Forward for additional description and disclosure.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value

Tracking # 1-05100483 (Exp. 01/22)